How to get an ESG

Advantage

ESG Advantage enables our Private Market clients to make better decisions, build better businesses and create a better world.

Our proven ESG methodology identifies relevant ESG themes, highlights value creation opportunities and risks and importantly helps our clients track progress and take ACTION.

Our process is simple

1. We set up your portfolio

We onboard your portfolio, so that you are ready to go when you access the ESG Advantage for the first time.

2. We help you capture data that's already available

If required, our team of analysts alongside our AI technology can pre-populate data from available sources to further reduce the reporting burden on your fund managers and portfolio companies.

3. You send out questionnaires

Whenever you’re ready, you can send out pre-built questionnaires to your fund managers or portfolio companies to request relevant ESG information.

4. You receive data

Your fund managers or portfolio companies are given access to the platform to complete the questionnaire – and have ongoing access to their dashboard to view and manage data – Our analysts can help you verify this data if needed.

5. You monitor ESG performance

ESG information is aggregated and transformed into our 5-point rating scale, so at the click of a button you can see who is performing well and where there is more work to do.

6. You communicate results

The ESG dashboards can be downloaded in PDF report format, allowing you to communicate your ESG performance, progress and action plans to your investors, clients, employees and other stakeholders.

7. Take action

We believe the true value in ESG assessments are the actions that follow. ESG Advantage provides recommendations to improve performance based on our 15 years’ experience and 1000’s of assessments. Keep track of actions, KPIs, targets and objectives in one place.

Our methodology

Our methodology has been developed by our advisory team over our 15 year history and has helped deliver value to 100’s of clients.

Asset assessment

For investors we take a top-down approach, which builds on the concept of industry exposure. Fund Managers are asked to screen underlying assets on exposure to negative industries like fossil fuels and weapons as well as positive industries like renewable energy and health care. A deeper dive on an asset can be triggered on request where detailed information will be gathered using our bottom-up approach.

For Managers and Assets we adopt a bottom-up approach which is based on materiality1, one of the most important concepts in the world of ESG. We help investee companies and Assets identify and report on the themes most material to their business, from our proprietary ESG framework of 50 themes.

Based on selected performance, improvement opportunities are suggested that can be included in an Action Plan. Investee companies or Assets can use this Action Plan to define ESG roadmaps and track progress over time.

Finally, the platform can be used to track a number of key ESG indicators, including indicators like carbon footprint, board diversity and governance policies.

By combining materiality, performance assessment, ESG indicators and action plans going forward, our bottom-up approach takes the best elements from our proven methodology used for close to 15 years in our advisory business. Managers have clear insight into the key material themes within their portfolio, how those themes are being managed and what progress their investments are making.

Fund Manager assessment

We help Managers assess their own ESG Governance performance. Through the platform Managers are asked to provide evidence of their ESG integration – whether they have an ESG policy, how they incorporate ESG in investment decisions and what commitments to standards and frameworks they have made.

Carbon Footprint assessment

Our Investor, Manager and Asset solutions include a calculator to help firms calculate their scope 1 and 2 carbon footprint which is aligned with the GHG Protocol, the global standard framework for measuring greenhouse gas emissions. We have a seperate module for companies who want to measure their Scope 3 carbon footprint too.

EU Regulation

All solutions include assessments on SFDR and EU Taxonomy compliance. Our set of ESG indicators includes the 14 mandatory SFDR Principal Adverse Impact indicators.

Furthermore, in collaboration with 414 we are working on the development of specific EU Taxonomy and SFDR modules, allowing companies to easily assess if and how much Taxonomy aligned there are and support managers to report in accordance with the SFDR requirements for Article 8 and 9 products.

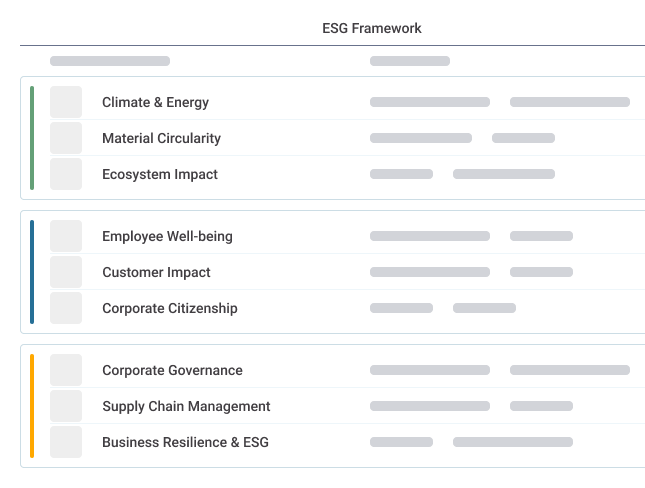

Our ESG framework

Our proven ESG methodology identifies relevant ESG themes, highlights value creation opportunities and risks and importantly helps our clients track progress and take ACTION.

Our ESG Framework has been developed over Holtara’s 15 years of experience working in ESG.

It is aligned with relevant regulatory and industry standards including PRI, SASB, GRI and TCFD, but tailored to the needs of our private market clients.

We stay ahead of industry developments, which means you do too…